Managing money is no longer just about keeping track of income and expenses. With increasing financial responsibilities loans, investments, taxes, savings, and retirement planning everyone needs the right tools to make smarter decisions.

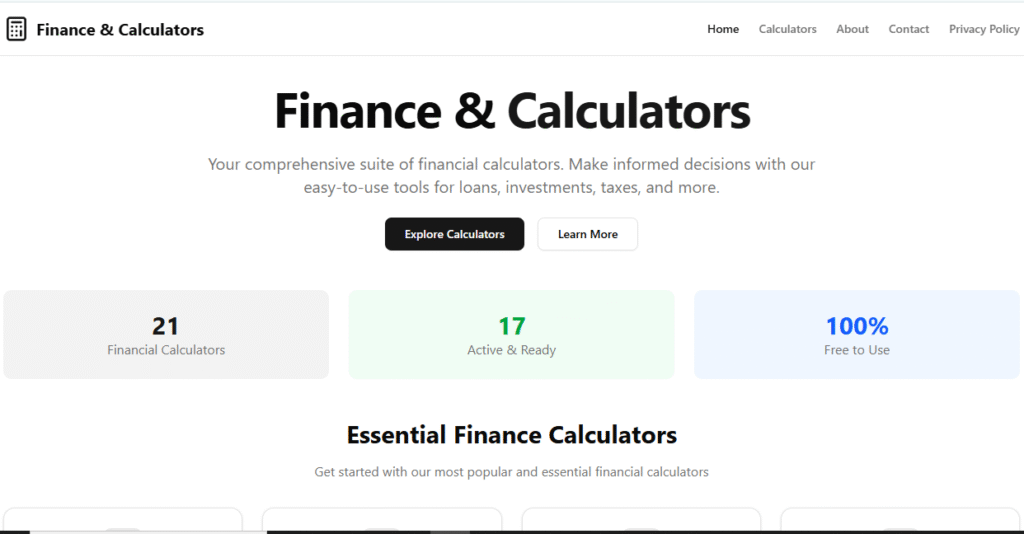

That’s where Tools by MusayyabShah.com comes in. We provide a comprehensive suite of financial calculators designed to simplify your financial journey. Whether you are calculating your EMI, planning for retirement, or analyzing stock profits, our calculators give you accurate results instantly.

In this blog, we’ll explore:

- Why financial calculators matter

- What makes our platform unique

- A detailed breakdown of each calculator and its purpose

- Why choosing an all-in-one solution saves time and effort

Why Use Financial Calculators?

Financial calculators are not just numbers on a screen they are decision-making tools. They help you:

- Save time by avoiding manual calculations

- Plan better for loans, savings, and investments

- Compare options like renting vs. buying or leasing vs. owning

- Avoid financial mistakes by making informed choices

- Gain clarity about your future wealth and expenses

Instead of relying on guesswork, you can use precise formulas built into our calculators to see real results.

What We Offer

At tools.musayyabshah.com, we bring together a wide range of calculators under one roof, so you don’t need to jump from one website to another.

1. Essential Calculators

For everyday financial needs:

- EMI Calculator – Find out your exact monthly loan installments.

- Loan Calculator – Estimate the cost of any loan.

- SIP Calculator – Calculate returns from mutual fund investments.

- FD Calculator – Predict maturity value of fixed deposits.

- RD Calculator – Plan monthly recurring deposits with ease.

- Compound Interest Calculator – Understand how money grows with compounding.

- Simple Interest Calculator – Quick interest calculations made simple.

2. Advanced Tools

For more complex planning:

- Mortgage Calculator – Plan your home loan and repayment schedule.

- Retirement Calculator – Secure your future by estimating retirement savings.

- Tax Calculator – Get clarity on tax liabilities.

- Investment Return Calculator – Measure ROI on different investment strategies.

- Credit Card Payoff Calculator – Plan to pay off credit card debt faster.

- Debt-to-Income Calculator – Understand your debt ratio for better financial health.

- Budget Calculator – Track income vs. expenses effectively.

3. Specialized Tools

For unique financial planning:

- Inflation Calculator – Know how inflation affects purchasing power.

- Salary to Hourly Calculator – Convert annual salary into hourly wage.

- GST Calculator – Calculate Goods & Services Tax instantly.

- Stock Profit & Loss Calculator – Analyze stock trade outcomes.

- Break-even Calculator – Find out when your business starts making profit.

- Home Affordability Calculator – Decide how much house you can truly afford.

- Car Loan vs Lease Calculator – Compare owning vs leasing a vehicle.

Detailed Purpose of Each Calculator

Let’s dive deeper into how these calculators help you in real life.

EMI & Loan Calculators

Purpose: Help borrowers calculate monthly installments and total repayment based on loan amount, interest rate, and tenure.

Why Use: Saves time, ensures you don’t overcommit financially.

SIP & Investment Return Calculators

Purpose: Plan systematic investments in mutual funds and predict long-term returns.

Why Use: Makes wealth-building strategies more reliable.

FD & RD Calculators

Purpose: Show how much your fixed or recurring deposits will grow over time.

Why Use: Helps compare bank offers and lock money smartly.

Compound vs. Simple Interest

Purpose: Compare how interest grows under different conditions.

Why Use: Understand the true value of savings or loans.

Mortgage & Home Affordability Calculators

Purpose: Plan home purchases with clear visibility on loan eligibility and affordability.

Why Use: Prevents you from buying beyond your financial capacity.

Retirement Calculator

Purpose: Estimate how much you need to save for a comfortable retirement.

Why Use: Ensures financial independence in old age.

Tax Calculator

Purpose: Calculate tax liabilities as per rules.

Why Use: Avoids surprises during tax season.

Credit Card Payoff & Debt-to-Income

Purpose: Manage debt effectively by planning repayment and tracking your DTI ratio.

Why Use: Improves credit score and reduces stress.

Budget Calculator

Purpose: Balance income vs. expenses.

Why Use: Encourages savings and financial discipline.

Inflation Calculator

Purpose: Understand the impact of inflation on your future money.

Why Use: Helps in long-term planning like retirement or education funds.

Salary to Hourly Calculator

Purpose: Break down annual salary into hourly pay.

Why Use: Useful for freelancers, part-timers, and job comparisons.

GST Calculator

Purpose: Quickly find GST amount for goods/services.

Why Use: Helps both businesses and consumers.

Stock Profit & Loss Calculator

Purpose: Calculate profit or loss on trades.

Why Use: Guides better investment decisions.

Break-even Calculator

Purpose: Identify when your business covers its costs.

Why Use: Critical for startups and small businesses.

Why Choose Us Over Others?

- One Platform, All Tools – No need to search across multiple websites.

- User-Friendly – Simple interface designed for everyone, not just finance experts.

- Accurate & Reliable – Calculators built on tested financial formulas.

- Always Updated – Regularly improved as per new tax laws and financial rules.

- Accessible Anywhere – Mobile and desktop-friendly.

Instead of juggling multiple apps, you get everything in one place.

Sitemap and Resource Pages

Our platform ensures easy navigation and SEO optimization with dedicated pages:

Meet the Creator.Each calculator has its own dedicated page for focused SEO ranking:

- EMI Calculator

- Loan Calculator

- SIP Calculator

- FD Calculator

- RD Calculator

- Compound Interest Calculator

- Simple Interest Calculator

- Mortgage Calculator

- Retirement Calculator

- Tax Calculator

- Investment Return Calculator

- Credit Card Payoff Calculator

- Debt-to-Income Calculator

- Budget Calculator

- Inflation Calculator

- Salary to Hourly Calculator

- GST Calculator

- Stock Profit & Loss Calculator

- Break-even Calculator

- Home Affordability Calculator

Final Thoughts

Finance doesn’t need to be complicated. With tools.musayyabshah.com, you get a single, reliable, and user-friendly platform that brings together all the financial calculators you’ll ever need.

Whether you’re a student, professional, investor, or business owner our tools empower you to make smarter financial decisions every day.

Start exploring today at tools.musayyabshah.com and take control of your financial future!